In 2024, shipping a 40ft container from Shanghai to Los Angeles often cost over $7,500. In early 2025, that same shipment can be booked for as low as $5,200—a drop that could put thousands of dollars back into your business.

Industry data points to two main drivers: an oversupply of vessels and shifting trade routes that are pushing rates down. For e-commerce sellers, wholesalers, and retailers, this is a rare opportunity to lock in lower costs and protect your margins.

Yet, not every importer is automatically seeing these savings. Without understanding your actual shipping from China to USA price—the total cost that includes ocean freight, surcharges, and destination fees—and knowing which parts of that price you can control or negotiate, you might still be overpaying on every container.

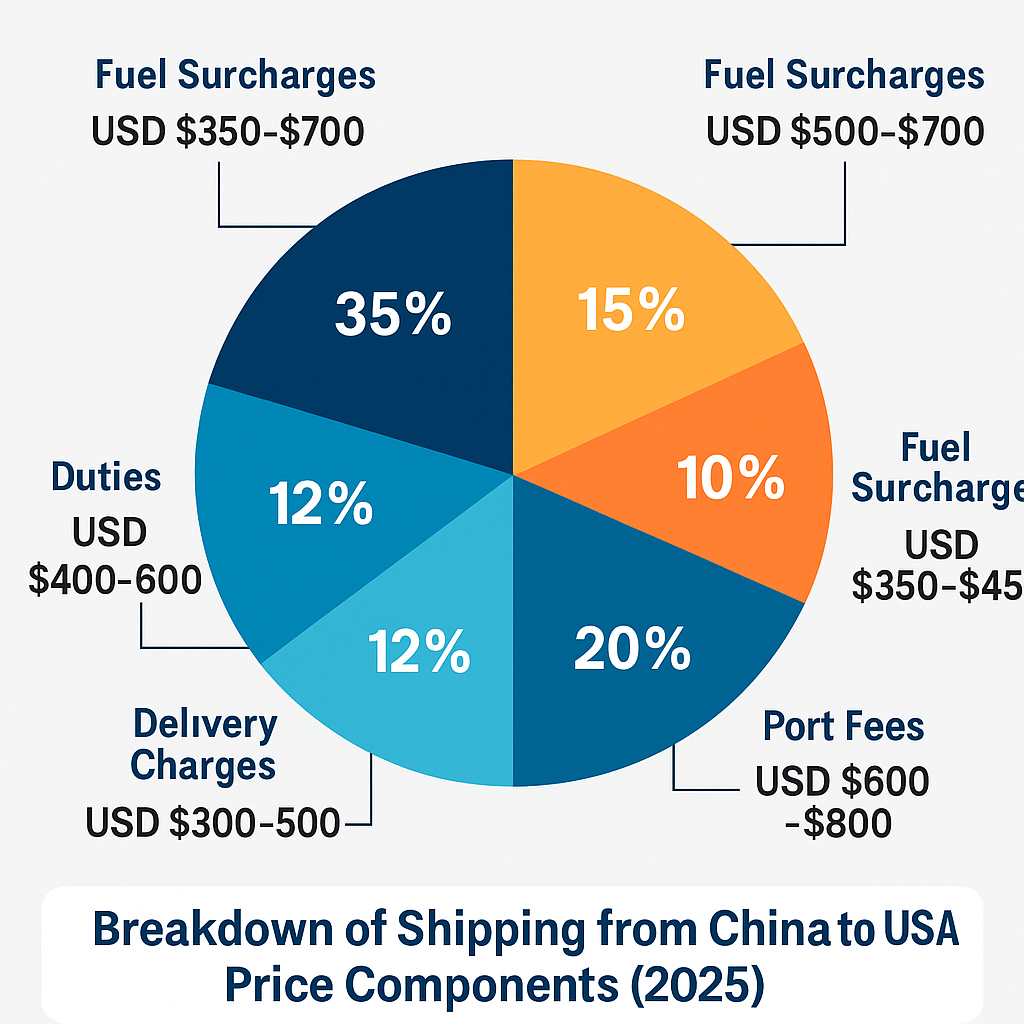

Breaking Down Your Freight Bill: Where the Savings Hide

Every freight invoice has multiple cost components—some fixed, some flexible, and some negotiable. In Q1 2025, here’s how they typically break down and where you can find savings:

- Base Ocean Freight – The core shipping cost set by carriers. With current vessel overcapacity, early bookings can secure rates 10–15% lower than average.

- Fuel Surcharges (BAF) – Linked to global oil prices; with fuel down ~8% this year, forwarders can sometimes pass along reductions mid-contract.

- Peak Season Surcharge (PSS) – Applied in high-demand months (Aug–Oct). Avoidable if you can shift shipments to off-peak periods like February or May.

- Port & Terminal Handling Charges (THC) – Mostly fixed, but less congested ports can reduce delays and extra fees.

- Customs Clearance & Duties – Correct HS code classification can significantly lower duty rates.

- Destination Delivery Fees – Door-to-door service costs more, especially for inland destinations; compare with arranging local transport yourself.

Once you know your cost drivers, the next big decision is container size—a factor that can quietly add or save hundreds of dollars per shipment.

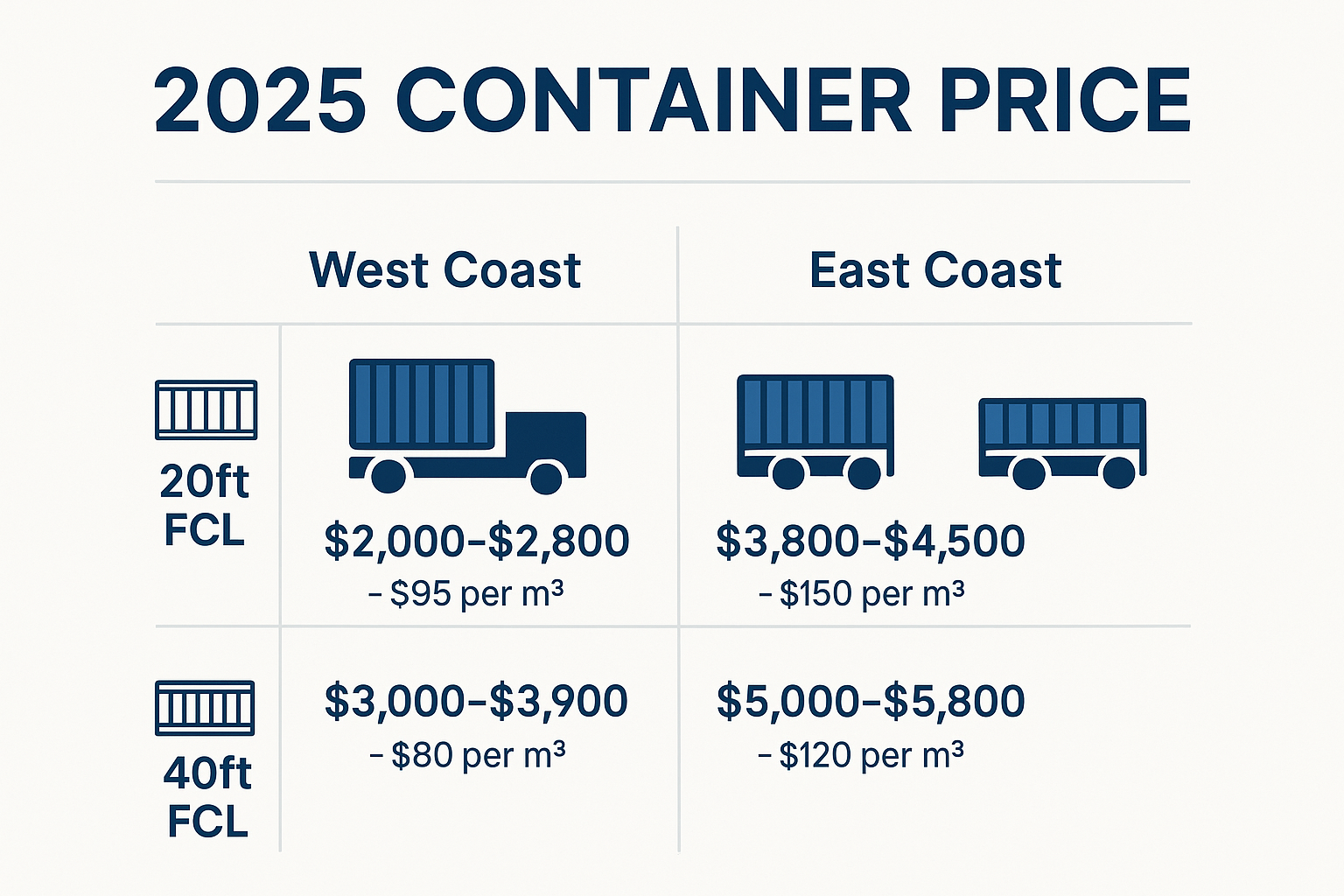

Container Price Insights: 20ft vs 40ft—Pay Less by Choosing Right

In early 2025, the price gap between 20ft and 40ft containers is smaller than many importers expect. Choosing the wrong size could mean paying more per cubic meter than necessary.

Average Q1 2025 Rates:

- West Coast (LA/Long Beach):

- 20ft FCL: $2,000–$2,800

- 40ft FCL: $3,000–$3,900

- East Coast (New York/Savannah):

- 20ft FCL: $3,800–$4,500

- 40ft FCL: $5,000–$5,800

Check the latest Container Price for your port and season to make informed decisions.

When to Choose a 20ft: Small shipments under 25–28 m³, high-value items, or urgent deliveries.

When to Choose a 40ft: Large volumes, bulky goods, or seasonal stock replenishment—often 20–30% cheaper per cubic meter.

LCL Alternative: Best for very small shipments; West Coast LCL rates average $45–$60/m³.

But size isn’t the only factor—when and where you ship can make just as much difference.

Seasonal and Route-Based Price Gaps You Can Exploit

Shipping rates fluctuate with the calendar and the route.

Seasonal Patterns in 2025:

- Peak Season (Aug–Oct): +$300–$600 per container.

- Post-Holiday Lull (Jan–Feb): 10–20% cheaper than peak.

- Mid-Year Stability (May–June): Balanced cost and transit times.

Route Differences:

- West Coast: Lower base rate, faster transit (14–18 days from Shanghai).

- East Coast: Higher ocean rates (+$1,500–$2,000) but potential savings on inland delivery to eastern markets.

Understanding these patterns is good—but applying them in a targeted strategy is even better.

Proven Strategies to Lower Your 2025 Shipping from China to USA Price

- Book Early – Save 10–15% with bookings 3–4 weeks ahead.

- Consolidate Shipments – Combining smaller loads into a full container can save $1,500+ per trip.

- Choose the Right Incoterms – FOB gives you control over the forwarder; CIF can hide inflated freight costs.

- Use Multi-Modal Transport – Combine ocean + rail to avoid port congestion delays.

- Negotiate with Forwarders – Commit forecasted volumes for better contract rates.

Mini Case:

An Amazon seller shipping 10 containers/year cut their average cost from $4,000 to $3,350 by booking early, consolidating, and working with a forwarder who had contract rates.

To make these strategies even more effective, you need to time your bookings right—and that’s where rate tracking tools come in.

Using Rate Tracking Tools to Lock in the Best Deal

Even with the right strategies in place, shipping rates can change weekly—sometimes even daily—based on fuel prices, capacity, and global demand shifts. If you’re not tracking these movements, you could miss the chance to book at the lowest point.

Why Rate Tracking Matters in 2025:

- Rates from China to the USA have shown swings of $200–$500 per container within the same month.

- Knowing when carriers release promotions or when demand dips can mean locking in rates before they rise again.

Practical Tracking Options:

- Freight Index Platforms – Tools like the Shanghai Containerized Freight Index (SCFI) or Freightos Baltic Index publish weekly rate trends for major routes.

- Forwarder Alerts – Many freight forwarders offer email or WhatsApp updates when rates drop for your preferred route.

- Custom Spreadsheets – If you ship regularly, log rates from multiple forwarders weekly. Over time, patterns will emerge, helping you anticipate price cycles.

Pro Tip: Combine tracking with your shipment planning calendar. For example, if you see rates drop in the second week of the month, align your booking schedule to capture that dip consistently.

While tracking tools help you time your bookings, partnering with a skilled freight forwarder can give you early access to exclusive rates and even more leverage to negotiate.

How a Freight Forwarder Turns Good Savings into Great Savings

- Negotiating Power: Access to 10–25% lower contract rates through volume deals.

- Optimized Container Usage: Maximize space to 95–100% fill rate.

- Avoiding Hidden Fees: Proactive rerouting to prevent congestion surcharges.

- Compliance Expertise: Prevent costly customs delays.

Let’s see how this works in a real shipment.

Case Study: Shanghai–Los Angeles $ Savings in Action

Before Optimization:

- Base Freight: $3,900

- Fuel: $350

- Peak Season Surcharge: $400

- Total: $4,900

After Optimization:

- Base Freight: $3,250 (forwarder contract rate)

- Fuel: $310

- Peak Season Surcharge: $0 (off-peak schedule)

- Total: $3,760

Savings: $1,140 per container (~23%). Across 20 containers/year: $22,800 saved.

Here’s how you can start capturing similar savings today.

Conclusion: Start Saving on Every Shipment This Year

2025 offers a rare window for importers to significantly cut their freight costs. By booking early, choosing the right container size, taking advantage of off-peak seasons, and working with reliable partners, businesses can make meaningful savings without compromising delivery times or service quality.

The key is to stay informed about market changes and to be proactive rather than reactive. Whether you manage a few shipments a year or a steady flow of containers, the decisions you make this year could have a lasting impact on your bottom line well beyond 2025.